Advancing Economic Forecasting and Risk Analysis Models to Meet Demands of the 4IR

Managing dynamic complexity will pave the way for a more prosperous and efficient economy that operates with less risk and better predictability.

Economic systems that operate through a constantly expanding number of dynamic interactions have become too complex to fully represent using popular econometrics and economic modeling methods. When multiple functions of economy are connected to each other explicitly or through complex topology, the mathematics of these methods grows too complex to deliver reliable predictions. History has shown that an economic crisis, mathematically identified as a singularity, may occur even when classic estimations fail to expose a risk.

From our experience, it is clear that new tools and methodologies are needed to augment traditional risk analysis practices in order to take back control of financial systems. The intended goal is to guide rather than react to market fluctuations in ways that yield the desired outcomes, including the ability to execute a complete system disruption, when and if the dynamics of financial markets no longer meet the goals of society.

Lack of predictability and hyper-risk within financial systems

Today’s economists borrow their risk modeling methods from the core tenants of physical science with a heavy reliance on the concept of entropy to deal with the volatility of financial systems. While these methods did make it easier to represent the approximate behavior of financial systems once upon a time, they have become meaningless in today’s complex environment.

The current lack of predictability and hyper-risk within financial systems is a direct result of dynamic complexity. Dynamic complexity should be considered the enemy of the digital age because its presence erodes stability, hides risk and creates waste within any system that is influenced by the external environment in which it operates. Like an undiagnosed cancer, dynamic complexity consumes valuable resources as it grows without providing any useful return. Traditional forecasting methods are unable to quantify the impact of dynamic complexity, therefore surprises are inevitable because no one can predict how one small change can produce a ripple effect of unintended consequences.

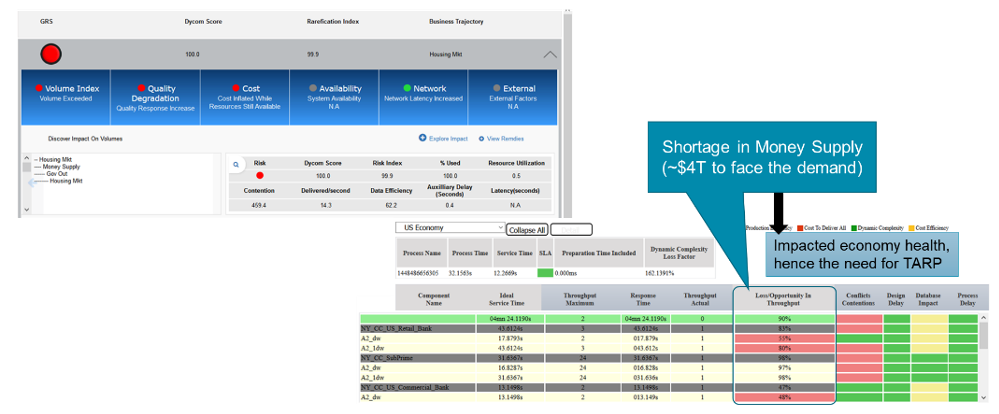

In and of itself, the expansion of subprime loans in the early-to-mid 2000s was considered a manageable risk by economists, policymakers and financial practitioners who took advantage of the Feds interest rate reduction monetary policy to promote new financial instruments, e.g. subprime loans and trading of mortgage-backed securities (MBS). Even as the collapse of the US economy was already happening, the Feds main economic model saw a less-than-5-percent chance that the unemployment rate would rise above 6 percent in two years. The rate actually hit 10 percent, an event that the model said was close to impossible, therefore it was not considered as a plausible risk by policymakers.

Crises move faster than decisions

As the pace of innovation accelerates in the Fourth Industrial Revolution (4IR), the cause and effect of economic crisis will become nearly instantaneous. Governments and businesses can no longer afford to wait for the warning signs of an economic turmoil, before taking action. To regenerate prosperity for the betterment of humanity, economists, policymakers and financial practitioners must employ new problem-solving approaches. Eliminating the waste and managing the risk caused dynamic complexity will deliver new opportunities for growth and sustainability. But first, economic stakeholders must tame dynamic complexity and simplify decision cycles.

In the research paper entitled, “Advancing Economic Forecasting and Risk Analysis Models to Meet the Speed, Risk and Sustainability Demands of the 4IR,” URM Forum proposes a new approach to economic forecasting and predictive analysis that allows users to uncover a wide scope of unknown risks. Armed with this knowledge, economic stakeholders will be able to quickly take action with confidence in the outcomes—before imbalances proliferate through financial markets and interdependent subsystems. We believe the suggested use of tensors provides the right formulation to overcome the abused application of entropy and scalar quantities within economics, which neglect the direction of market changes. The utilization of aggregated vectors allows users to more accurately reproduce the magnitude and direction of market behaviors, which in turn allows economists, policymakers and practitioners to predict a wider range of risks and vet which corrective actions will yield the best results.

Learn more about our Economic Forecasting and Risk Analysis Modeling research

Advancing Economic Forecasting and Risk Analysis Models” paper to learn how economists, policymakers and practitioners to can use our proposed UDE method to predict a wider range of risks and vet which corrective actions will yield the best results.